By

Mariah Collins, SHRM-CP

on

Sep

11,

2025

14 min read

0 comment(s)

-1.webp?width=1200&height=800&name=PEO-vs-HRO%20(1)-1.webp)

Small and mid-sized companies can quickly become overwhelmed by human resources tasks due to lack of time, staff or resources to handle them. When completing these tasks prevents the company from focusing on its core functions, leadership often looks to outsourcing as a solution.

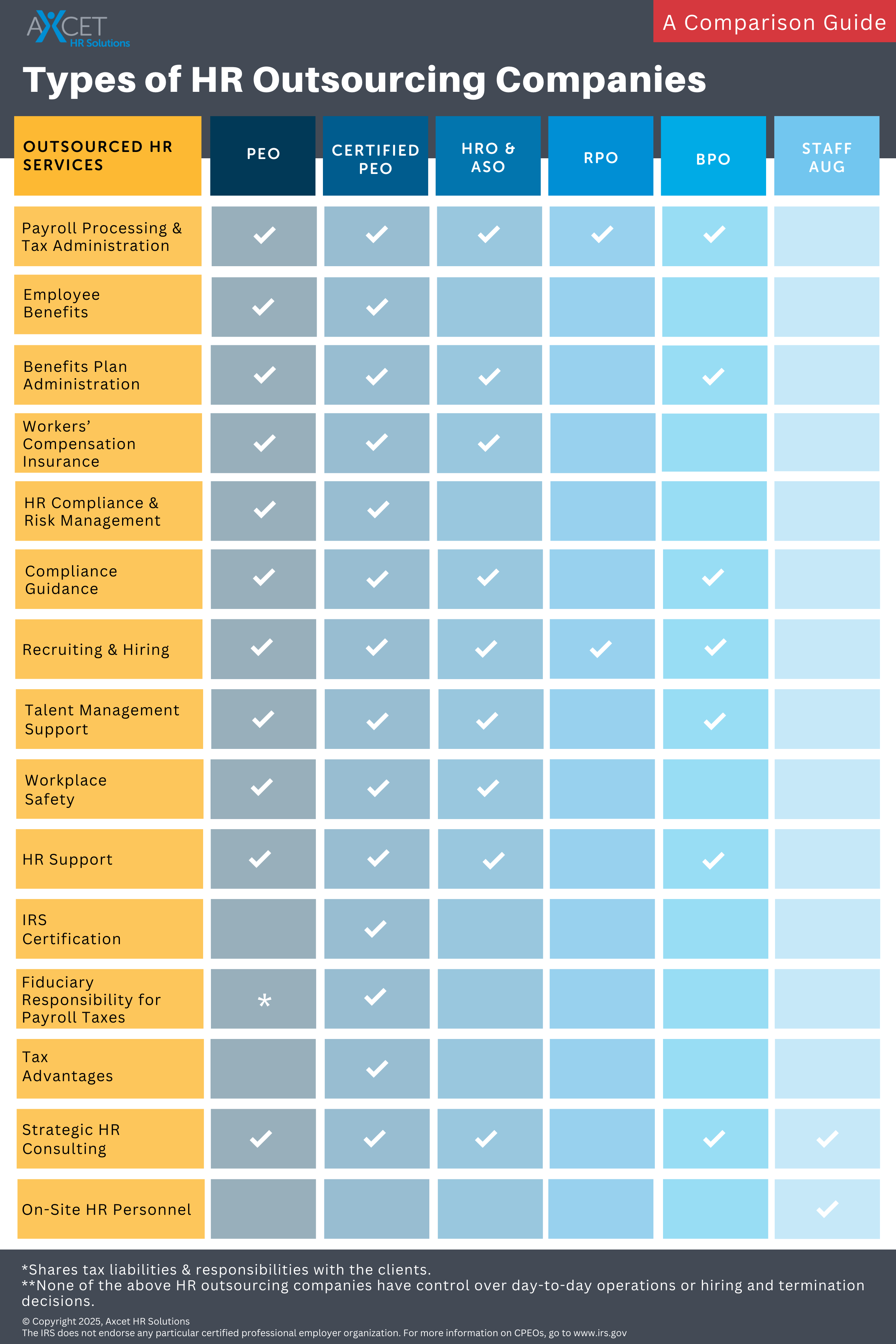

The first decision smaller businesses face when deciding to outsource is whether to hire a professional employer organization (PEO) or a human resources outsourcing (HRO) company.

HROs provide human resources administrative support on an a la carte basis, meaning employers choose only the services they believe they need. While this option can provide more flexibility, employers must shop carefully to make sure the HRO offers enough support for the services provided.

Many HROs specialize in offering only one or two primary services. Businesses that need a more broad-based HR solution can feel confident choosing a PEO instead.

RELATED: Certified PEO vs Non-Certified PEO - What to Know Before You Outsource HR >>

One of the most important things for employers to understand about working with a PEO is that the PEO becomes the employer of record with the federal and state governments. As a co-employer, the PEO offers dozens of services in employee benefits, human resources, payroll administration, and risk management. PEO companies also ensure that clients remain in compliance with benefit and workplace regulations at the federal, state and local levels.

The co-employer relationship also allows businesses with fewer than 50 employees to benefit from a PEO’s collective bargaining power for employee benefits and workers’ compensation.

Premiums for high-quality health care and workers’ compensation insurance may not be affordable for smaller employers attempting to obtain coverage on their own. But, because insurers price policies based on group size, being part of a PEO’s larger group can be a significant advantage.

Beyond the cost savings on premiums, clients that obtain their workers’ compensation coverage through a PEO typically participate in a “pay-as-you-go model” that eliminates large premium deposits, annual payroll audits and the time-consuming administrative burden that comes from managing it all.

RELATED: Top Benefits of Outsourcing HR Functions to a PEO >>

Professional employer organizations provide immense benefits to small and medium-sized businesses (SMBs), especially those in growth mode. According to the National Association of Professional Employer Organizations, small and mid-sized businesses seek HR solutions through PEOs for a variety of reasons.

Some only need help with payroll and benefits administration, while others need a third-party organization to play a more intricate role in HR functions so leaders can focus on the core business.

While it may be relief enough simply to offload your business’ human resources burden – including compliance with local and national employment laws, payroll and payroll taxes, risk management and employee benefits – to a trusted partner, the benefits reaped from the PEO relationship extend well beyond the outsourcing of these essential business functions.

PEOs and HROs have some similarities but use different business models. With a PEO, employers can save money by bundling services.

Because of the co-employer relationship, the company retains control over day-to-day operations and the supervision of employees.

The PEO manages most aspects of HR, including employee benefits, payroll administration and workers’ compensation.

Small companies can outsource these functions entirely so owners can refocus on company expansion and growth.

Small companies comparing PEOs and HROs can expect these similarities:

Although HROs provide guidance on insurance products, they do not offer plans directly to clients. Companies that opt to work with HROs typically have an established HR department and only need to outsource a few functions.

After weighing the differences between PEO and HRO models, many employers find it helpful to request a consultation to talk through which option best aligns with their goals, risk tolerance, and growth plans.T

PEOs provide a full suite of HR solutions, ranging from recruitment strategy to termination. Examples of PEO solutions include:

This is by no means an all-inclusive list of the employer services offered by Axcet HR Solutions, a PEO in Kansas City. You can learn more about Axcet HR Solutions and PEOs in general by reviewing this frequently asked questions page. What's more, PEOs often provide these lesser-known services that can benefit your business >>

Choosing between an HRO and a PEO can feel like a big decision. To make it easier, we’ve created a quick six-question quiz that highlights whether your business could benefit most from the comprehensive support a PEO provides.

You might be considering hiring an HR person, especially if your small business is experiencing rapid growth. Executing that decision may present a bigger challenge than you imagined.

Here’s why: People quit their jobs in staggering numbers in 2021. Between April and June that year alone, more than 11 million people voluntarily left their jobs. In 2022, more jobs were available than there were people to fill them. While the hot job market is predicted to cool somewhat in 2023, businesses are still expected to be in an “employee market,” with one of the biggest challenges being finding enough high-quality candidates.

So, if you’re looking to hire an HR manager at your company, it may be a challenge to find an available candidate who has your desired experience, education and salary requirements. HR applicants are in the driver’s seat when it comes to salary and benefits negotiations, and competition for these professionals is heated.

There are other options, however. If your company has up to 50 employees, hiring a PEO to serve as an outsourced human resources department gives you access to experts who are knowledgeable and experienced in every HR situation your company is facing or will face. Having that team available whenever you need it may be more cost-effective than it would be to hire a full-time HR person, and the PEO provides you with greater flexibility as your company grows.

If you decide to work with a PEO, you don’t have to compete for HR expertise. Instead, you can work with a well-established, affordable PEO firm – staffed with HR experts – that has your best interests at heart.

If your company has more than 50 employees, you probably need – and may already have – an internal HR leader (or team) in place. In this instance, partnering with a PEO provides your HR department with supplementary services and resources.

Managing a company with limited resources is counterproductive. PEOs understand this, which is why they offer a turnkey solution to relieve client burdens and enable small businesses to operate in growth mode.

Businesses in almost every industry benefit from and seek out the expertise of PEOs to provide comprehensive HR support. In fact, clients range from accounting firms and technology companies to real estate organizations, non-profit organizations, manufacturers, retailers, doctors, lawyers and engineers.

According to NAPEO, PEOs provide services to 175,000 SMBs, employing 3.7 million people. In fact, the total employment represented by the PEO industry is roughly the same as the combined number of employees for Walmart (United States only), Amazon, IBM, FedEx, Starbucks, AT&T, Wells Fargo, Apple and Google.

While almost any size business may find value in a PEO relationship, including companies of more than 500 employees, most PEO clients are small (with 10 to 49 employees) and medium-sized organizations (those with 50 to 250 employees). The average client of a NAPEO member company is a business with 19 full-time worksite employees.

RELATED: PEOs Create Scalable HR Infrastructure for Small Businesses >>

Businesses use PEOs for multiple reasons: expertise, buying power, automation and others. PEOs cost-effectively fill a gap for small and medium-sized businesses that don’t have the resources to hire or add to an in-house HR team, need buying power to offer more competitive group employee benefits or would be hard-pressed to afford the latest HR technology.

Small to mid-sized businesses with 10 to 50 or more employees may feel they are too small to hire a payroll administrator and a human resources manager. Hiring a PEO puts a broad range of expertise at their disposal. PEOs are comprised of professionals who are experienced in all aspects of human resources—from payroll to legal matters to compliance issues to employee benefits and beyond.

RELATED: Top Benefits of Hiring SHRM- or HRCI-Certified HR Consultants >>

Employers with fewer than 50 employees do not have the same resources available to them as large organizations do when it comes to attracting and retaining top talent. Salary is just one of many factors prospective employees consider when deciding whether to accept a job offer from a new employer.

Small businesses may be able to compete on pay, but job candidates also review benefits such as health, dental and life insurance to determine if the entire compensation package meets their needs.

Unfortunately, this is where small and medium-sized employers often lose talented candidates to larger businesses that can afford to offer more impressive benefits packages.

When a talented individual receives two or more job offers, acceptance often comes down to the availability and affordability of benefits such as health insurance and retirement savings more than any other factor. PEOs help to level the playing field by negotiating for the lowest rates and best coverage with a large pool of insurance providers.

For clients that want this option, a PEO can serve as a “co-employer” representing the interests of multiple clients. PEOs then have the ability to lock in rates for Fortune 500-style benefits that their SMB clients could not receive on their own.

So, smaller companies, and often even those with more than 200 employees, find using a PEO can fulfill their payroll, HR and benefits needs.

RELATED: Small Businesses, Health Insurance and the PEO Option >>

Leading-edge human resources technology is costly. Large, enterprise-sized organizations can afford to buy and maintain technology that streamlines their HR processes, but most small and mid-sized businesses can’t.

PEOs give these smaller companies access to sophisticated systems such as online applicant tracking, new employee onboarding, benefits enrollment and payroll and time and attendance systems. Smaller businesses then have the power and efficiencies to make their operations hum and their employees happy.

Operating an onsite HR department is an expensive endeavor that starts with the need to hire highly skilled and experienced professionals. Having HR staff work onsite also requires additional office space for a team that does not generate revenue. Yet, no company can survive without a dedicated team to handle vital HR administrative tasks.

Small businesses save the overhead expenses associated with onsite HR staff when they choose to partner with a professional employer organization. By outsourcing time-consuming payroll and HR duties, they avoid paying guaranteed salaries, benefits and additional expenses to equip and maintain an onsite HR department. The ability to switch to a variable rather than fixed expenses for HR leaves more room in the budget for discretionary spending.

Mid-sized businesses with existing HR departments can save money by working with a PEO, too. A PEO becomes an extension of an in-house HR department, providing extra insights and hands-on assistance without the company having to invest in hiring additional HR team members.

Keeping track of hundreds of federal, state and local regulations is a time-consuming task. Regulations’ complexity makes it challenging to understand and implement them, and they change frequently.

These challenges leave smaller businesses vulnerable to fines and other penalties from the federal government, Internal Revenue Service and state and local governments. Even well-intentioned business owners can make mistakes that subject the company to fines and other penalties.

Here are just a few of the regulations that require all employers’ compliance:

These four federal regulations are among the hundreds that employers must follow. Government intervention has increased so dramatically over the last few decades that employers face six times the number of regulations they did in the 1980s.

The increased regulations place an enormous administrative burden on businesses of all sizes, but larger companies have more resources to hire compliance experts.

Outsourcing the work to a team of HR compliance specialists at a PEO is typically more cost-effective for companies with fewer than 100 employees.

RELATED: How a PEO Helps Reduce Your Small Business Liability >>

All employers must pay into their state’s worker’s compensation program to pay employee expenses related to injury or illness on the job. They also need to manage the claims process, including maintaining ongoing communication with affected employees and developing a return-to-work program. Like payroll, benefits and regulatory compliance, managing workers’ compensation can present a significant administrative burden for smaller companies.

Working with a PEO relieves businesses of the need to keep up with workers’ compensation claims, on top of everything else. Claims administration – everything from post-accident drug testing and accident investigation to the creation of a light-duty program after receiving a workers’ compensation claim – is part of a PEO’s overall risk management services. Risk management also includes employee safety training and evaluation of onsite risks to help prevent accidents before they lead to claims.

Outsourcing HR functions to a PEO can be challenging for entrepreneurs who struggle with wanting to control all aspects of the companies they started. PEOs are sensitive to this and are willing to take on as many or as few HR tasks as the small business owner feels comfortable outsourcing.

HR staff also may feel threatened rather than supported. Again, an experienced PEO can manage this situation and give in-house HR managers confidence that the PEO is present to act as a partner that enhances the work the internal HR team already is doing.

A representative from Axcet HR Solutions is happy to discuss any concerns or potential drawbacks of working with a PEO during the initial consultation.

The National Association of Professional Employer Organizations reports that:

The COVID-19 pandemic further underscored the benefits small companies gain by working with a PEO. From a percentage standpoint, PEO clients were:

Fifteen percent of American companies with 10 to 99 employees use professional employer organizations. Industry analysts predict that the number will continue to climb steadily as more business owners from small and mid-sized companies realize how outsourcing HR functions to a PEO enables them to compete with larger organizations and focus on core business functions, enabling faster company growth.

PEOs provide a full suite of first-class human resources services to their business clients, including payroll services, payroll taxes, group employee benefits plans and compliance with local, state and federal employment laws. Beyond these essential HR functions, some PEOs help to manage the entire employee lifecycle, from recruiting and onboarding to leadership training, investigating harassment allegations and assisting in unemployment claims.

In doing so, PEOs give their clients the time and energy to focus on their companies’ core competencies so they can maintain and grow their bottom lines.

RELATED: How PEOs Help Your Business Grow >>

If you’re looking to increase your business’ productivity, improve performance, reduce turnover and grow in today’s competitive marketplace, a partnership with the right PEO may be the solution for your small or medium-sized business. With more than 30 years of experience operating under the PEO co-employment model, Axcet HR Solutions provides a range of services in human resources, payroll administration, employee benefits and risk management for small and medium-sized businesses in the greater Kansas City metropolitan area and the surrounding region.

Axcet was one of the first PEOs in the country to earn the Certified PEO designation for surpassing IRS criteria regarding organizational integrity and financial responsibility. Our company is also proud to have earned an OSHA VPP Site Award for demonstrating an ongoing commitment to workplace safety in our own organization and that of our clients. We have earned the OSHA award for nine consecutive years.

Scheduling a consultation to learn more about partnering with Axcet is a great step toward achieving long-term business success. We invite all employers with fewer than 250 employers to learn more about our services and how partnering with us can improve efficiency and the bottom line.

“I paid for HR services from two other payroll providers before I found Axcet. As bad as those other experiences were, it has helped me to fully appreciate the team at Axcet. Things are always clear, concise and timely. I have never, ever had to wait for an answer regarding my employees and I’ve had a number of challenging HR things happen this year. Having Axcet is truly like having an HR specialist, one I really like interacting with, in the office right next to me.”

– N.C., Axcet client and owner at a local Kansas City-based medical supply company.

*The IRS does not endorse any particular certified professional employer organization. For more information on certified professional employer organizations, go to www.irs.gov.

Let us know what you think...