By

Jo McClure, CPP

on

May

16,

2025

14 min read

6 Comments

.webp?width=1200&height=800&name=what-is-a-certified-peo-jo-mcclure-Axcet-HR%20(1).webp)

Understanding the distinction between a CPEO vs PEO—or, more precisely, a certified PEO vs. non-certified PEO—is crucial for small and medium-sized businesses (SMBs), which form nearly half of the country's workforce.

Running an SMB means juggling multiple demands—strong leadership, aligning teams to a shared vision and creative problem-solving—all while trying to grow their businesses.

Given these demands, outsourcing HR functions can be a game-changer. That's where professional employer organizations (PEOs) and certified professional employer organizations (CPEOs) come in.

But what’s the difference between a CPEO vs PEO and why does certification matter? Let’s break it down.

A certified PEO (CPEO) is approved by the IRS and assumes full responsibility for federal employment taxes. In contrast, a non-certified PEO does not, leaving your business potentially liable if the PEO fails to remit taxes.

CPEOs also protect tax credits and prevent wage base restarts—advantages traditional PEOs may not provide.

A PEO (Professional Employer Organization) is a firm that provides a range of HR services to businesses through a co-employment relationship. This typically includes:

✔ Payroll processing

✔ Employee benefits administration

✔ HR compliance assistance

✔ Workers’ compensation and workplace safety

In this arrangement, the PEO becomes the employer of record for tax and benefits purposes, but the client maintains responsibility for managing employees.

However, a traditional, non-certified PEO does NOT assume sole liability for employment taxes. If the PEO collects payroll taxes but fails to remit them to the IRS, the client company may still be held liable.

A CPEO (Certified Professional Employer Organization) offers all the same HR and payroll services as a PEO but with one major difference—it has successfully met the IRS's requirements for certification.

This IRS certification provides significant tax advantages to businesses, including:

✅ The ability to retain federal tax credits (which may be lost under a standard PEO).

✅ Elimination of wage base restarts for Social Security and Medicare taxes when switching mid-year.

✅ Sole liability for employment taxes—once the client pays the CPEO, the IRS cannot pursue the client for unpaid payroll taxes.

Additionally, CPEOs must adhere to continuous IRS reporting and bonding requirements, ensuring their financial stability and compliance with federal regulations.

RELATED: The Best PEO Meets These 5 Qualifications >>

Both certified and non-certified PEOs provide HR outsourcing, but only a certified PEO (CPEO) carries IRS recognition, financial safeguards and significant tax benefits.

This distinction—certified PEO vs non-certified PEO—can impact everything from tax liability to peace of mind. Now that we’ve explored how each works, let’s take a side-by-side look at how they compare.

While the comparison chart above provides a quick comparison, understanding the full impact of these differences can help businesses make a more informed decision.

Let’s take a deeper look at the five biggest distinctions between a CPEO vs PEO.

A CPEO must meet rigorous IRS standards that a non-certified PEO does not. These include:

Traditional, non-certified PEOs do not undergo this level of scrutiny.

With a non-certified PEO, both the PEO and the client share tax liability. If the PEO fails to pay employment taxes, the IRS can pursue the small business for unpaid amounts—even if the business already sent the payments to the PEO.

With a CPEO, the IRS recognizes it as the sole party responsible for tax payments. Once the business pays the CPEO, it is legally protected from any further tax liability.

One major concern for small businesses considering a PEO is whether they will lose access to federal tax credits.

Switching to a traditional PEO mid-fiscal year can trigger wage base restarts, which means small businesses may have to pay payroll taxes twice on the same employees due to a change in the Federal Employer Identification Number (FEIN).

A CPEO prevents this costly issue. When businesses switch to a CPEO mid-fiscal year, they avoid double taxation on Social Security and Medicare wages.

A CPEO provides a higher level of financial security, tax compliance and risk mitigation. This peace of mind is why many small businesses choose a CPEO vs PEO.

Would you choose a bank that wasn’t insured by the FDIC? Probably not. The same logic applies to choosing an HR provider—IRS certification provides essential protections.

Now that we've covered the main difference between a certified PEO vs non-certified PEO, let's learn more about CPEOs and PEOs, and the services and benefits they provide small to mid-sized businesses.

Not all PEOs are created equal. The biggest distinction between a certified PEO vs non-certified PEO comes down to IRS recognition and the legal protections that come with it.

While both may offer HR services, only certified PEOs can shield clients from federal tax liability and wage base restarts.

The CPEO designation is not easy to obtain—the IRS sets strict requirements that must be met before certification is granted. To qualify, a PEO must:

✅ Undergo a rigorous IRS review process, including financial audits and tax compliance checks.

✅ Provide extensive documentation proving it has paid all employment taxes on time.

✅ Maintain positive working capital to demonstrate financial stability.

✅ Ensure that all key personnel pass background checks, particularly those responsible for tax payments.

✅ Submit quarterly CPA-reviewed tax filings to confirm ongoing compliance.

✅ Post a substantial IRS-mandated bond to guarantee its ability to meet payroll tax obligations.

Only a small percentage of PEOs achieve CPEO status. In fact, out of 900+ PEOs in the U.S., fewer than 10% are certified by the IRS.

Here at Axcet HR Solutions, we are proud to have met all requirements, including a documented history of federal, state and local tax compliance, financial responsibility and organizational integrity, and to have been among the first 10% of PEOs in the nation to become certified by the IRS.

In fact, we are the only local PEO headquartered in Kansas City, to receive the IRS designation of certified PEO and to have maintained our certification, uninterrupted, since first earning it in 2017.

“Axcet HR Solutions is committed to operating according to the highest standards. We take every measure to ensure our clients have the utmost peace of mind when they partner with us for all of their business’ HR needs.”

-Jo McClure, Axcet HR Solutions Director of Payroll Administration

Both CPEOs and traditional PEOs operate under the PEO model, serving as a co-employer to small businesses. They take on responsibilities for key business functions, including:

Managing payroll and payroll taxes is complex and time-consuming. PEOs and CPEOs streamline payroll operations by handling:

However, not all payroll service providers offer the same level of protection. Here’s how different third-party arrangements compare:

Payroll Service Providers (PSPs)

Reporting Agents (RAs)

Section 3504 Agents

A CPEO offers unmatched protection by ensuring:

✔ Full IRS compliance and tax security.

✔ Clients retain their tax credits (which may be lost under a traditional PEO).

✔ Businesses avoid wage base restarts and double payroll tax payments.

Choosing a CPEO vs PEO or payroll provider means fewer risks and greater financial peace of mind.

RELATED: The Surprising ROI of Payroll Outsourcing for Small Businesses >>

Staying compliant with employment regulations is essential to avoid costly fines and legal risks. CPEOs and PEOs help businesses navigate complex compliance requirements, including:

✅ Payroll tax compliance – Ensuring accurate tax reporting and timely payments.

✅ Unemployment insurance – Managing state and federal UI requirements.

✅ Workers’ compensation – Providing proper coverage and claims management.

✅ Workplace safety – Assisting with OSHA compliance and risk mitigation.

✅ HR compliance – Keeping policies aligned with labor laws and industry regulations.

A strong employee benefits package is key to attracting and retaining top talent. Both CPEOs and PEOs help small businesses access high-quality benefits at competitive rates, including:

✅ Health, dental and vision insurance – Group plans with better pricing.

✅ Retirement plans – 401(k) and other savings options.

✅ Insurance premium discounts – Lower rates due to larger risk pools.

✅ Enrollment and claims management – Simplified administration for employers and employees.

By partnering with a CPEO or PEO, small businesses can offer Fortune 500-level benefits without the high costs or administrative burden.

Workplace safety is essential, but many small businesses may not recognize hidden risks that could lead to injuries or costly fines. Both CPEOs and PEOs provide expert guidance to help employers create a safer work environment, including:

✅ Workplace safety audits – Identifying hazards and compliance gaps.

✅ OSHA compliance assistance – Preparing for and responding to inspections.

✅ Injury prevention strategies – Implementing cost-effective safety measures.

✅ Risk mitigation training – Educating employees on workplace safety best practices.

When considering a CPEO vs PEO, both help reduce liability, lower workers’ comp costs and ensure regulatory compliance.

RELATED: Risk Management Strategies - The Transformative PEO Approach >>

In a competitive job market, small businesses need strong hiring and retention strategies to attract top talent. Both CPEOs and PEOs provide expert support in:

✅ Recruiting and job positioning – Helping businesses stand out to top candidates.

✅ Applicant screening and assessment – Ensuring the right fit for each role.

✅ Onboarding support – Streamlining the hiring process for a smooth transition.

✅ Workplace culture development – Enhancing employee engagement and retention.

By partnering with a CPEO or PEO, businesses gain expert guidance to build a skilled, motivated workforce.

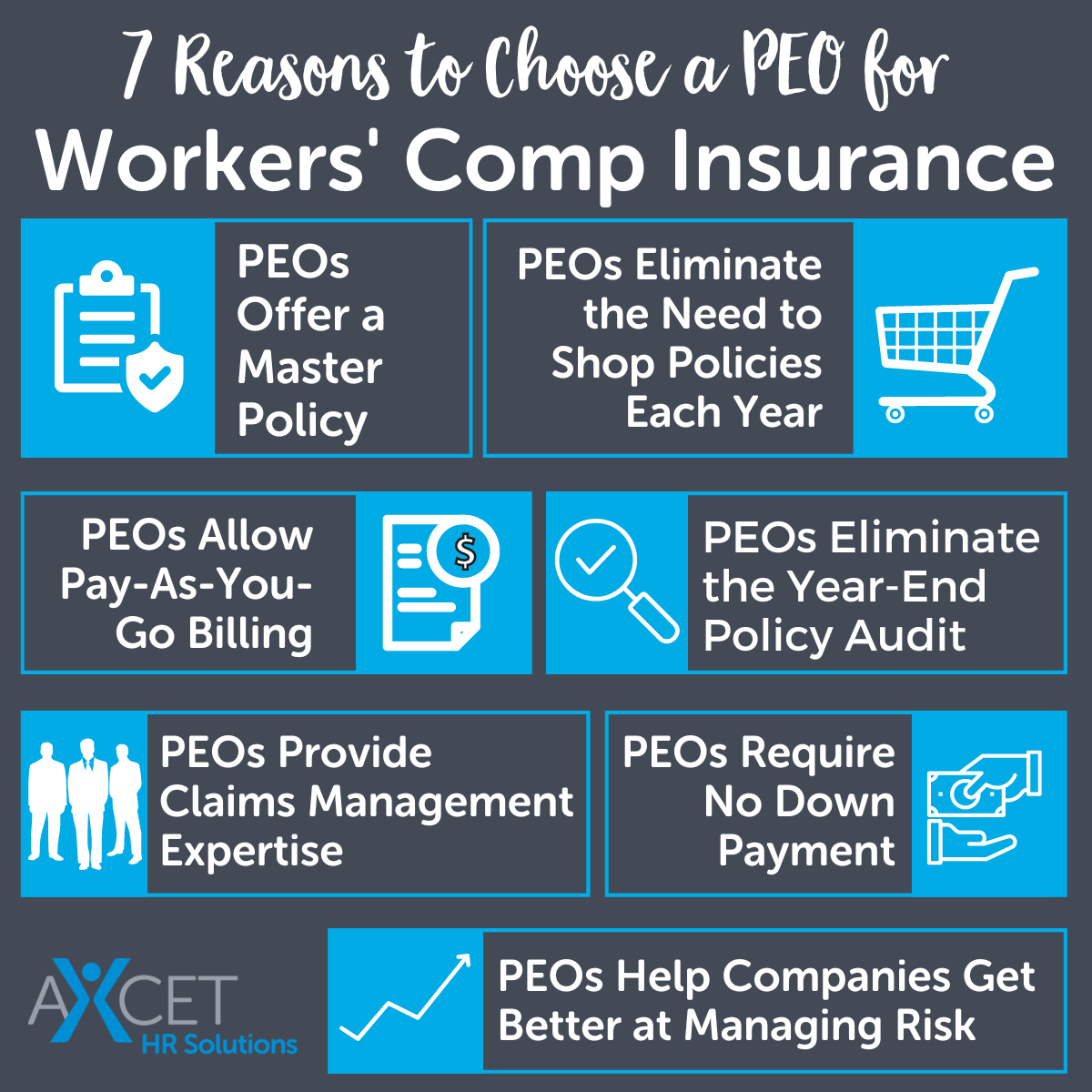

Managing workers’ compensation can be complex, requiring businesses to navigate claims, compliance and insurance premiums. Both CPEOs and PEOs take on this responsibility by:

✅ Handling workers' comp coverage – Ensuring businesses have the right insurance.

✅ Managing claims and paperwork – Reducing administrative burden.

✅ Ensuring compliance – Keeping businesses aligned with state and federal regulations.

✅ Providing risk management support – Helping reduce workplace injuries and lower premiums.

Helping employees plan for retirement is a valuable way to show appreciation and retain top talent. Both CPEOs and PEOs offer expert guidance on:

✅ 401(k) and retirement savings plans – Helping businesses choose the best options.

✅ Employer contribution strategies – Structuring plans to maximize employee benefits.

✅ Plan administration and compliance – Handling enrollment, reporting, and regulatory requirements.

A CPEO or PEO makes it easier for small businesses to offer competitive retirement benefits while staying compliant.

Axcet Makes Offering Retirements Benefits Easy: Learn About Our Small Business 401(k) Plans >>

Tracking employee performance helps businesses identify strengths, address skill gaps, and drive productivity. CPEOs and PEOs assist with:

✅ Employee review processes – Developing structured evaluations.

✅ Performance metrics and goal setting – Using data to enhance productivity.

✅ Reskilling and development strategies – Offering training to strengthen workforce skills

Small businesses often lack the resources for a dedicated in-house HR team, leaving owners or managers to handle HR challenges alone. CPEOs and PEOs provide:

✅ HR policy development – Ensuring businesses stay compliant.

✅ Employee relations support – Managing workplace concerns effectively.

✅ HR consulting and best practices – Providing expert solutions for day-to-day issues.

If you're weighing a CPEO vs PEO, both enable businesses to gain access to expert HR professionals without the cost of an internal team.

RELATED: PEO Cost Considerations - Is It Worth the Investment? >>

Choosing a CPEO is a significant decision, and the right fit can impact your business's HR functions, compliance, and growth. Before selecting a provider, ask these five key questions:

RELATED: Top Benefits of Hiring SHRM or HRCI Certified HR Consultants >>

RELATED: Level Funded vs Self Funded vs Fully Funded >>

✅ A thorough vetting process ensures you choose a CPEO that aligns with your business needs and goals.

A CPEO is certified by the IRS and assumes full tax liability, while a standard PEO shares liability with the client.

It ensures payroll taxes are handled properly and shields the business from IRS pursuit if a PEO fails to remit taxes.

Yes. Businesses may lose eligibility for certain federal tax credits when working with a non-certified PEO.

The IRS imposes strict audits, bonding, and financial requirements that only the most compliant firms can maintain.

Axcet offers the same tax and compliance protections as national firms with local, personalized HR expertise.

Axcet HR Solutions has been a trusted PEO since 1988 and was among the first 10% of PEOs nationwide to achieve IRS certification as a CPEO in 2017.

We’ve maintained that certification uninterrupted, ensuring small and mid-sized businesses receive trusted, compliant and expert HR support.

✅ Recruiting and Onboarding Support

✅ Better Benefits at Competitive Rates

✅ Local, Personalized HR Expertise

✅ Unmatched Industry Experience

Want to Learn More? Download Our FREE eBook: Certified PEOs - Your Easy to Understand Guide >>

If you're weighing the benefits of a certified PEO vs. non-certified PEO, Axcet offers the peace of mind that comes with full IRS certification and decades of trusted experience.

📞 Contact us today to learn how partnering with an IRS-certified PEO can benefit your business.

* The IRS does not endorse any particular certified professional employer organization. For more information on CPEOs, go to www.irs.gov

Let us know what you think...