By

Jeanette Coleman, SPHR & SHRM-SCP

on

Feb

06,

2024

9 min read

0 comment(s)

.webp?width=1200&name=50-employee-HR-compliance%20(1).webp)

Reaching the milestone of 50 employees is a pivotal moment for any growing business, marking your transition into the realm of an "applicable large employer." This achievement reflects your dedication and the substantial progress your business has made from its early days. Yet, with this success comes a new landscape of HR responsibilities and regulatory compliance that can seem daunting.

As an applicable large employer (ALE), your business now operates under a microscope of federal regulations, significantly different from the more flexible early stages of growth. This shift necessitates a deeper understanding and strategic approach to HR management to navigate the complexities introduced by the Affordable Care Act (ACA), Family and Medical Leave Act (FMLA), and the regulations enforced by the Equal Employment Opportunity Commission (EEOC).

This guide is designed to help you embrace this new chapter at your business with confidence, helping you understand the critical changes in compliance and HR management strategies that will support your continued growth and success.

An applicable large employer is a designation under the ACA that identifies businesses subject to specific healthcare reporting and coverage obligations. This determination is crucial for understanding a business's responsibilities under the ACA. The Internal Revenue Service (IRS) is the federal agency responsible for defining and enforcing the criteria for applicable large employer status, which primarily revolves around the size of an employer's workforce.

The core criterion for applicable large employer status is having 50 or more full-time employees or full-time equivalent (FTE) employees on average during the previous calendar year. Here's a closer look at how this calculation is made:

According to the IRS, a full-time employee is someone employed on average at least 30 hours per week, or 130 hours in a calendar month. This includes employees with consistent working hours as well as those whose hours may vary.

This category is designed to account for part-time employees in a way that reflects their combined contribution to a workforce equivalent to full-time employees. To calculate FTEs, an employer must total the hours of service for all part-time employees in a month and divide by 120. The sum of this calculation for each month, divided by 12 (the number of months in a year), gives the average number of FTEs for the year.

Employers should calculate their full-time employees and FTEs each month. This involves adding the number of full-time employees to the number of FTEs derived from part-time employees' hours.

The monthly totals are then added together and divided by 12 to find the annual average. If this average is 50 or more, the employer is considered an applicable large employer for the current calendar year.

There's an exception for seasonal workers. If an employer's workforce exceeds 50 full-time employees for 120 days or fewer during a calendar year, and the employees in excess of 50 during that period are seasonal workers, the employer may not be considered an applicable large employer.

The IRS regulations also consider certain related companies (those with a common owner or part of a controlled group) as a single employer for determining applicable large employer status. This means the employee totals from all entities within the group are combined.

For businesses not in existence throughout the prior year, the determination of applicable large employer status is based on the expectation of the number of employees they will have in the current year.

Being classified as applicable large employers has significant implications for businesses, primarily related to the Employer Shared Responsibility provisions under the ACA. While specifics of compliance will be detailed in the next section, understanding this is the first step in navigating the complexities of healthcare legislation.

The IRS provides detailed guidance and resources to help employers determine their status, calculate FTEs and understand the implications of this designation. It's essential for businesses to accurately assess their workforce each year to ensure compliance and avoid potential penalties.

For businesses that meet the applicable large employer threshold, having 50 or more full-time employees or equivalent, navigating ACA mandates becomes an essential part of their operational compliance. The ACA sets forth specific provisions aimed at ensuring employees have access to quality and affordable health coverage.

Central to the ACA's approach to expanding healthcare coverage is the employer-shared responsibility provisions. These rules compel applicable large employers to offer health insurance that is affordable and provides a minimum level of coverage to their full-time employees and their dependents.

The essence of these provisions is not just to mandate the offering of health insurance but to ensure that the offered coverage meets quality and affordability standards that align with the broader goals of the ACA. Read more about employer-shared responsibility provisions here >>

To avoid penalties, employers with 50 or more employees must cover enough of the monthly premium costs for their company-provided health insurance to keep workers’ contributions below the maximum amount allowed by the ACA. Find out more in this blog post >>

Three methods determine affordability by using the shared-responsibility affordability percentage which is determined by the IRS and has been set at 8.39% for 2024, down from the 2023 limit of 9.12%.

Health insurance coverage will satisfy the affordability requirement if the lowest-cost self-only coverage option available to employees does not exceed 8.39% of an employee’s household income. This adjusted rate is on a "plan year" basis, not a yearly basis.

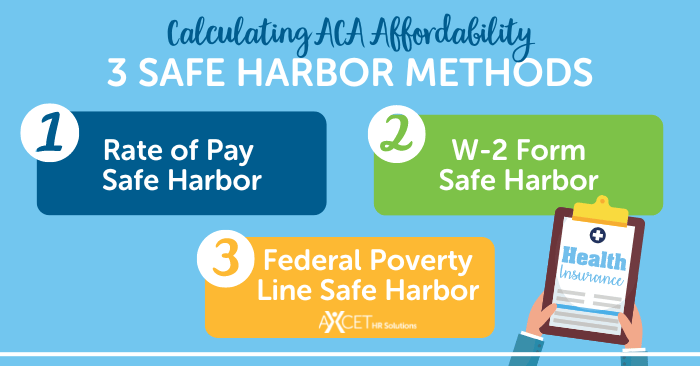

There are three safe harbor methods to calculate affordability to ensure your plan meets ACA requirements. According to the IRS, applicable large employers may choose to use one safe harbor for all of their employees or to use different safe harbors for employees in different categories.

For the latter, categories must be reasonable. Additionally, one safe harbor can be used by the employer on a uniform and consistent basis for all employees in a particular category.

This method allows employers to calculate affordability based on the employee's rate of pay at the start of the coverage period. When using the rate of pay safe harbor, multiply the employee’s monthly salary by 8.39% (for the 2024 plan year) to determine the maximum monthly amount that can be taken from the employee’s wages each month for health insurance.

For hourly employees, assume 130 hours are worked each month and then use the lower figure of these two calculations to determine the maximum monthly amount allowed to be taken from the employee’s wages for health insurance. Here's how that looks:

Applicable large employers may consider the affordability of health coverage based on the wages reported in Box 1 of the employee's W-2 form. This method offers a straightforward, year-end assessment of affordability relative to the employee's taxable income.

To determine affordability using the W-2 method, take an employee’s W-2 wages for the month and multiply by 8.39%.

The result defines the monthly maximum your business could take from the employee’s wages each month to pay for a minimally qualifying health plan. W-2 wages for the entire or part of a calendar year may be used.

Employers can also base affordability on a fixed percentage of the federal poverty line for a single individual. This method provides a clear benchmark that simplifies the affordability calculation without needing to delve into each employee's specific income details.

According to the IRS, for the 2024 plan year, businesses will need to calculate 8.39% of the one-person household federal poverty figure for the previous year and divide that number by 12 to get the monthly employee premium.

For example, the Federal Poverty Line for a one-person household in 2023 was $14,580. Multiply this figure by 8.39% and then divide by 12 to get the maximum monthly amount. Using this safe harbor, an employee's premium payment in 2024 can't exceed $101.93 per month ($14,580 x 8.39% = $1,223.26 divided by 12 months).

As long as your business offers a plan that costs less than that for employee-only coverage, you meet ACA affordability criteria.Under the FMLA, you won’t automatically be a covered employer subject to the law immediately upon reaching the 50-employee mark. Rather, this occurs once you’ve had 50 or more employees within a 75-mile radius for at least 20 workweeks. Then your private-sector business will be considered a covered employer and subject to the FMLA.

FMLA-eligible employees are entitled to up to 12 workweeks of unpaid, job-protected leave for certain family and medical reasons in a 12-month period.

RELATED: Unraveling the FMLA in Uncommon Situations >>

According to the DOL, employers subject to the FMLA are required to make, keep and preserve certain records including:

The EEOC enforces anti-discrimination laws including Title VII of the Civil Rights Act, Pregnancy Discrimination Act, Equal Pay Act, Age Discrimination Act and the Americans with Disabilities Act.

Some laws under the EEOC apply as soon as your business has one employee, like equal pay. Others apply once your business has 15 employees and even more come into play at the 20-employee mark.

However, once your business reaches 50 or more employees and has $50,000 in federal contracts, it must have a written affirmative action plan which clearly states which policies are in place at your organization to ensure compliance with anti-discrimination laws.

Additionally, businesses with 50 or more employees and $50,000 in government contracts must complete and file an annual EEO-1 Report. The EEO-1 Report is mandated by federal statute and regulations and collects employment data from businesses on race, ethnicity, gender and job category.

RELATED: Eight Mistakes Companies Make When the EEOC Comes Knocking >>

The DOL administers and enforces over 180 federal laws protecting U.S. workers. Additionally, each state has its own set of employment laws. Employers must comply with both federal and state laws. Contact your experienced human resources consultant at Axcet HR Solutions to see if additional state laws in Missouri and Kansas will impact your business once you hit the 50-employee mark.

Managing compliance requirements, as applicable large employers, can be complex, but Axcet HR Solutions, a trusted professional employer organization (PEO), is here to provide the guidance you need. With our comprehensive HR services, we can help ensure you stay compliant with regulations and avoid potential pitfalls.

Don't let compliance issues overwhelm you. Schedule a consultation today. Let us help you navigate the intricacies of applicable large employer compliance when your business reaches 50 employees, ensuring a smooth and compliant operation.

Let us know what you think...